INSIGHTS

Why Lithium Is Becoming a Strategic Hedge for Miners

New lithium contracts show Iron Mine Contracting hedging commodity cycles as EV demand and project timelines reshape mining services

5 Jan 2026

Australia’s mining services sector is adjusting to the rise of battery minerals, with Iron Mine Contracting offering an early example of how contractors are repositioning as lithium demand grows. While iron ore and gold still dominate activity, recent contract awards point to lithium as a strategic hedge against traditional commodity cycles.

The shift is underlined by Iron Mine Contracting’s long-term mining services agreement at a major lithium project in Western Australia, announced in the past year. The multi-year deal covers core mining activities and requires the mobilisation of a large workforce and specialised equipment, tying the contractor to a project with a longer development horizon than many bulk commodities.

For analysts, the contract highlights a broader change in how some contractors are allocating capital and skills. “This reflects where future demand is expected to be,” said one mining analyst tracking contract awards in the sector. “Lithium projects tend to offer longer mine lives, which can support more stable contractor revenues if market conditions hold.”

The move does not suggest a wholesale shift across the industry. Instead, it points to a targeted strategy by contractors that have already built exposure to lithium. Iron Mine Contracting has accumulated experience at projects including Kathleen Valley, positioning itself as several Western Australian lithium developments move closer to production.

Market conditions provide part of the rationale. Lithium prices have been volatile over the past two years, reflecting rapid supply growth and uneven demand. Even so, global electric vehicle sales continue to rise, supporting expectations of stronger long-term demand for battery materials. Australia remains the world’s largest lithium producer by volume, with multiple projects scheduled to ramp up through the second half of the decade.

Policy settings form part of the backdrop, though indirectly. Federal initiatives such as Australia’s Critical Minerals Strategy focus on downstream processing and supply chain resilience rather than mining services. Industry participants say such frameworks can still support investment confidence and project timelines.

Developers are increasingly attentive to contractors with battery minerals experience, although this is rarely formalised in tender criteria. Longer-term contracts also bring greater exposure to approval delays, price cycles and policy shifts, increasing execution risk.

For Iron Mine Contracting, lithium represents more than a single contract win. It is an effort to build capability in a commodity tied to global electrification, as the mining services sector navigates a more complex resources market.

Latest News

28 Jan 2026

Battery Recycling May Finally Make Economic Sense26 Jan 2026

A US$299M Bet on Breaking China’s Rare Earth Grip22 Jan 2026

Grid-Scale Batteries Add a New Charge to Lithium Demand21 Jan 2026

From Mine to Market, Australia Turns to Digital Proof

Related News

INNOVATION

28 Jan 2026

Battery Recycling May Finally Make Economic Sense

INVESTMENT

26 Jan 2026

A US$299M Bet on Breaking China’s Rare Earth Grip

MARKET TRENDS

22 Jan 2026

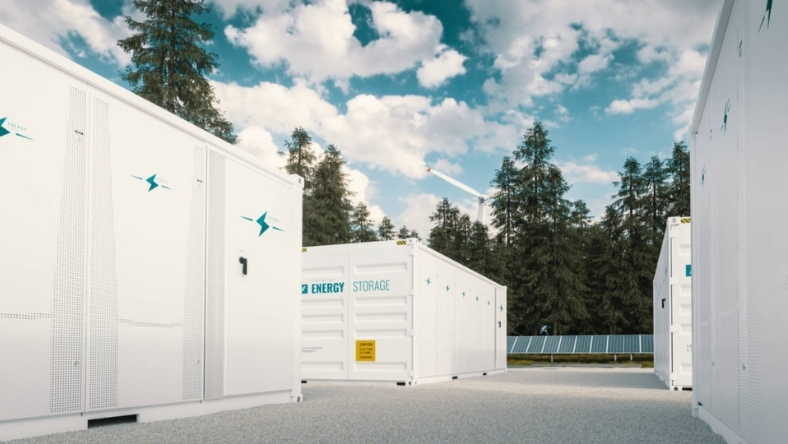

Grid-Scale Batteries Add a New Charge to Lithium Demand

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.