MARKET TRENDS

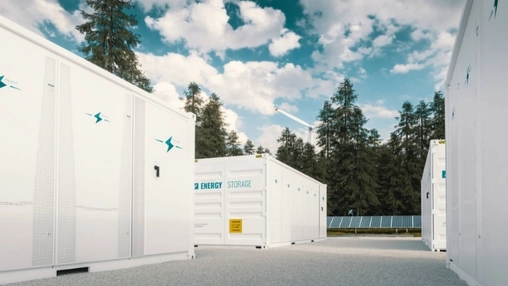

Grid-Scale Batteries Add a New Charge to Lithium Demand

Grid-scale batteries are emerging as a powerful new source of lithium demand, adding depth and stability to Australia’s battery minerals story

22 Jan 2026

For years, Australia’s lithium fortunes have risen and fallen with electric vehicles. Now another force is stepping onto the stage. Grid-scale battery storage is beginning to reshape how the market thinks about future demand.

Electric vehicles still dominate lithium consumption, and that is unlikely to change anytime soon. But large batteries designed to stabilise power grids and support renewable energy are growing fast. Analysts are increasingly factoring these projects into long-term demand outlooks, adding a new layer to a market once defined almost entirely by car sales.

The shift in sentiment is subtle but real. After a period of caution, investors and analysts are showing renewed interest in energy storage as a structural growth driver. Research from groups such as UBS and Macquarie highlights storage as a critical component of future energy systems, with lithium demand from these projects expected to rise sharply over the coming decade.

None of this is guaranteed. Forecasts vary widely, shaped by policy settings, approval timelines, technology choices, and the pace of supply growth. Electric vehicles will remain the anchor of demand for years. Storage is not a replacement. It is a complement, and potentially an important one.

What storage does bring is a different flavour of demand. Unlike consumer-driven EV sales, grid batteries often sit within infrastructure-style investments. They are backed by utilities, large developers, and government targets. That can lend a sense of stability, even though regulatory shifts and funding decisions still matter.

Equity markets are starting to take note. Commentary around lithium stocks increasingly points to storage demand as a possible buffer against the boom-and-bust cycles that have plagued the sector during periods of rapid expansion.

Miners are responding too. Discipline, cost control, and reliable delivery are being rewarded over aggressive growth. Customers, meanwhile, are prioritising long-term supply security rather than chasing volume at any price.

Policy adds another tailwind. Australia’s National Battery Strategy aims to strengthen global supply chains and deepen access to international markets, reinforcing the country’s role in the energy transition.

Challenges remain, from project delays to fierce global competition. Still, if planned storage deployments materialise, grid-scale batteries could become a defining influence on Australia’s battery minerals sector in the decade ahead.

Latest News

26 Jan 2026

A US$299M Bet on Breaking China’s Rare Earth Grip22 Jan 2026

Grid-Scale Batteries Add a New Charge to Lithium Demand21 Jan 2026

From Mine to Market, Australia Turns to Digital Proof20 Jan 2026

Australia Lithium Deal Tightens Global Battery Links

Related News

INVESTMENT

26 Jan 2026

A US$299M Bet on Breaking China’s Rare Earth Grip

MARKET TRENDS

22 Jan 2026

Grid-Scale Batteries Add a New Charge to Lithium Demand

TECHNOLOGY

21 Jan 2026

From Mine to Market, Australia Turns to Digital Proof

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.