INVESTMENT

From Ore to Output: Australia’s $500m Battery Leap

A $500m fund aims to turn Australia’s raw minerals into a homegrown clean-energy manufacturing industry

3 Nov 2025

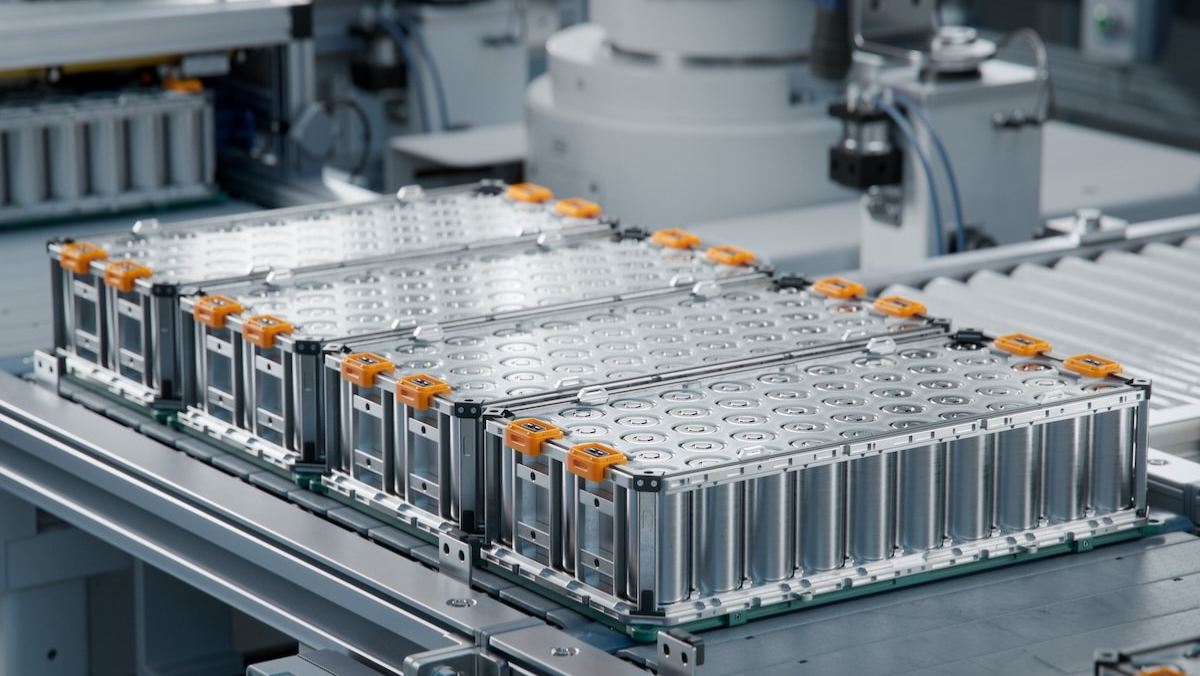

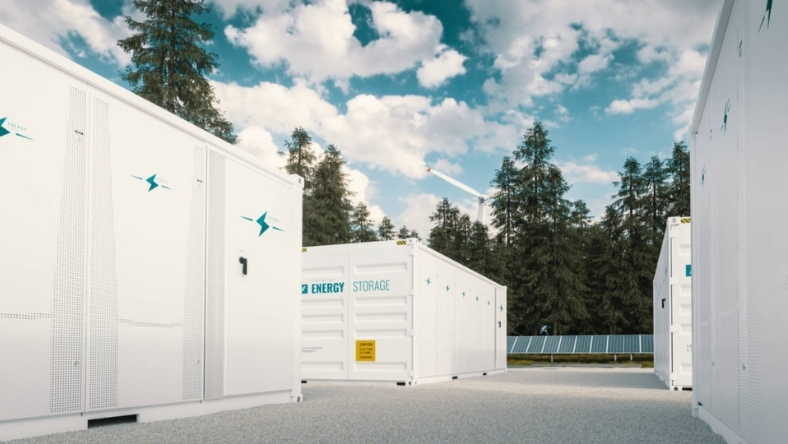

Australia is taking another step towards keeping more of the value from its mineral wealth. A new AUD 500m Battery Breakthrough Initiative (BBI), managed by the Australian Renewable Energy Agency, will offer grants and incentives to firms making battery cells, components and active materials. The goal is to turn the country’s lithium, nickel and cobalt reserves into finished products, not just exports of ore.

“Batteries are a critical component of the global move to reduce carbon emissions, and there is a huge opportunity for Australia to be part of this global demand,” said Tim Ayres, the industry minister. The scheme gives priority to projects that use renewable energy and domestically mined critical minerals, linking funding to technologies mature enough for commercial deployment.

Australia dominates lithium mining, but most refining and cell manufacturing occurs abroad. Darren Miller, ARENA’s chief executive, said the initiative “will enhance Australia’s battery manufacturing capability, improve supply chain resilience, and foster innovation.” It fits within the government’s broader Future Made in Australia plan to expand high-value manufacturing and reduce dependence on foreign supply chains.

The opportunity is clear. Analysts see the potential for new processing plants, cell-production lines and assembly facilities that could lift exports of finished battery systems. Yet hurdles remain. Asian producers enjoy vast economies of scale, and Australia’s workforce lacks experience in large-scale cell manufacturing. Regulatory approvals can take years.

Even so, the BBI signals a more active industrial policy. By tying public funding to technical readiness and scalability, the government hopes to crowd in private capital while avoiding past pitfalls of subsidy-heavy schemes. If it succeeds, Australia could evolve from a quarry for other nations’ clean-energy industries into a competitive player in its own right.

Latest News

28 Jan 2026

Battery Recycling May Finally Make Economic Sense26 Jan 2026

A US$299M Bet on Breaking China’s Rare Earth Grip22 Jan 2026

Grid-Scale Batteries Add a New Charge to Lithium Demand21 Jan 2026

From Mine to Market, Australia Turns to Digital Proof

Related News

INNOVATION

28 Jan 2026

Battery Recycling May Finally Make Economic Sense

INVESTMENT

26 Jan 2026

A US$299M Bet on Breaking China’s Rare Earth Grip

MARKET TRENDS

22 Jan 2026

Grid-Scale Batteries Add a New Charge to Lithium Demand

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.