MARKET TRENDS

Australia’s Minerals Vault Could Power a Battery Boom

Canberra launches a minerals vault for allies, reshaping supply chains and testing miners’ strength

2 Oct 2025

Australia is redefining energy security with a bold new plan: the launch of a national minerals reserve designed to anchor global battery supply chains. Announced earlier in 2025, the initiative invites allies including the United States, United Kingdom, France, and Canada to participate, though details of how stockpile shares and guaranteed offtake would work remain under negotiation.

In exchange, Australia aims to secure long-term funding and cement its role as a trusted supplier at the heart of the clean energy transition. With China still dominating global processing, the reserve reflects a broader push among Western nations to diversify and shield themselves from geopolitical shocks. If successful, the reserve could begin reshaping supply chains when it becomes operational in late 2026.

For Australia’s miners, the moment is pivotal. Lynas Rare Earths has raised A$750 million to expand its rare earths output, while Liontown Resources secured A$316 million to fast-track its Kathleen Valley lithium project. Both companies are betting on a future where government-backed demand brings stability to a historically volatile sector.

Prime Minister Anthony Albanese framed the plan as both economic and strategic, saying it will “future-proof our allies against coercive supply shocks.” Analysts suggest the shift could transform markets by placing governments, rather than just private buyers, at the center of long-term contracts. This new certainty may empower large producers but raises questions about whether smaller miners can keep pace in an era of state-backed deals.

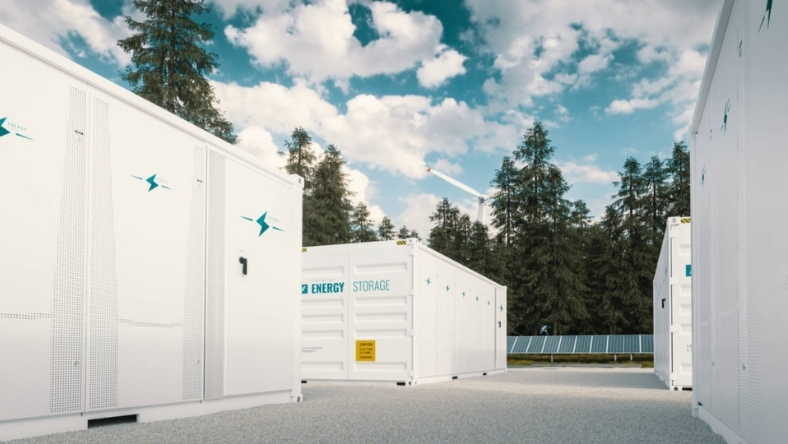

Industry observers note that the reserve is part of a wider race to lock in critical minerals as electric vehicle sales soar and renewable energy projects scale. By tying its resources directly to government partners, Australia is positioning itself not only as a supplier of raw materials but as a potential shaper of global clean technology pathways.

The plan is not without risks, yet it underscores a new reality: in the energy transition, security is no longer measured only in barrels of oil but in tons of minerals. If the reserve succeeds, it could set a precedent for how nations build resilience while accelerating the shift to a low-carbon future.

Latest News

28 Jan 2026

Battery Recycling May Finally Make Economic Sense26 Jan 2026

A US$299M Bet on Breaking China’s Rare Earth Grip22 Jan 2026

Grid-Scale Batteries Add a New Charge to Lithium Demand21 Jan 2026

From Mine to Market, Australia Turns to Digital Proof

Related News

INNOVATION

28 Jan 2026

Battery Recycling May Finally Make Economic Sense

INVESTMENT

26 Jan 2026

A US$299M Bet on Breaking China’s Rare Earth Grip

MARKET TRENDS

22 Jan 2026

Grid-Scale Batteries Add a New Charge to Lithium Demand

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.