INSIGHTS

Australia’s Lithium Industry Learns to Live With Less

With lithium prices sharply lower, Australian producers are cutting costs, testing downstream moves, and diversifying globally to defend value and relevance

22 Dec 2025

Australia’s lithium industry is entering a more restrained phase as producers respond to sharply lower prices and tougher global competition after years of rapid growth driven by electric vehicle demand.

Lithium spot prices have fallen more than 70 per cent from their 2022 peak, putting pressure even on low-cost producers. Australia remains the world’s largest source of mined lithium, accounting for more than half of global supply, but scale alone is no longer enough to protect margins.

The focus across the sector has shifted from expansion to resilience. Companies are prioritising cost control, productivity gains and balance-sheet strength as they prepare for a prolonged period of price volatility.

Pilbara Minerals, one of the country’s largest producers, has moved to streamline operations in Western Australia, placing less emphasis on volume growth and more on sustaining output through the cycle. The approach reflects a broader reassessment of what constitutes competitive advantage in a weaker market.

Some producers are also testing limited downstream strategies, though these remain selective rather than transformative. Pilbara’s partnership with South Korea’s POSCO is an example of a cautious move closer to processing and battery customers. The aim is to secure longer-term offtake agreements and reduce exposure to volatile spot markets, rather than to build full downstream integration.

Policy changes abroad are shaping these decisions. The US Inflation Reduction Act and the EU’s Critical Raw Materials Act are encouraging supply chains that rely on trusted and transparent sources. This has shifted competition towards compliance, traceability and reliability, areas where Australian producers argue they retain an edge.

Geographic diversification is another response. Pilbara’s expansion into Brazil reflects a desire to spread risk as costs rise and approval processes in Australia lengthen. Overseas projects bring political and operational challenges, but also offer flexibility in a more fragmented global market.

Downstream investment remains capital-intensive and demand is sensitive to economic conditions. Still, industry sentiment is cautious rather than pessimistic. The downturn is pushing companies to strengthen their operating models instead of pursuing rapid growth.

For Australia’s lithium sector, the adjustment may prove decisive. As global supply chains evolve, producers that combine efficiency with selective integration and diversification are seeking to preserve their relevance in the next stage of the battery industry’s development.

Latest News

28 Jan 2026

Battery Recycling May Finally Make Economic Sense26 Jan 2026

A US$299M Bet on Breaking China’s Rare Earth Grip22 Jan 2026

Grid-Scale Batteries Add a New Charge to Lithium Demand21 Jan 2026

From Mine to Market, Australia Turns to Digital Proof

Related News

INNOVATION

28 Jan 2026

Battery Recycling May Finally Make Economic Sense

INVESTMENT

26 Jan 2026

A US$299M Bet on Breaking China’s Rare Earth Grip

MARKET TRENDS

22 Jan 2026

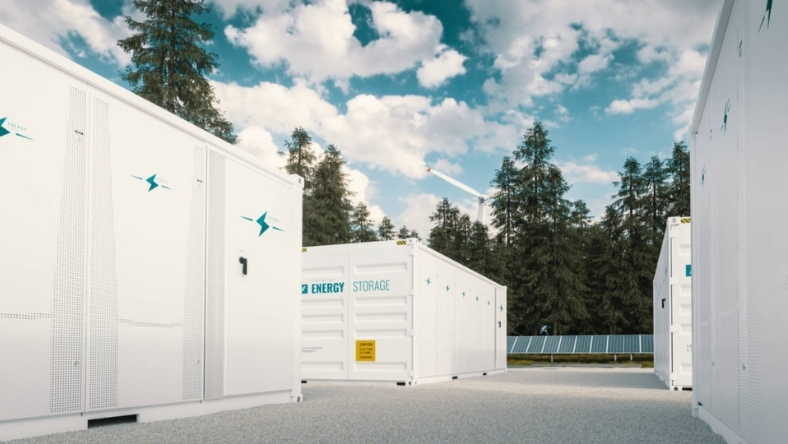

Grid-Scale Batteries Add a New Charge to Lithium Demand

SUBSCRIBE FOR UPDATES

By submitting, you agree to receive email communications from the event organizers, including upcoming promotions and discounted tickets, news, and access to related events.